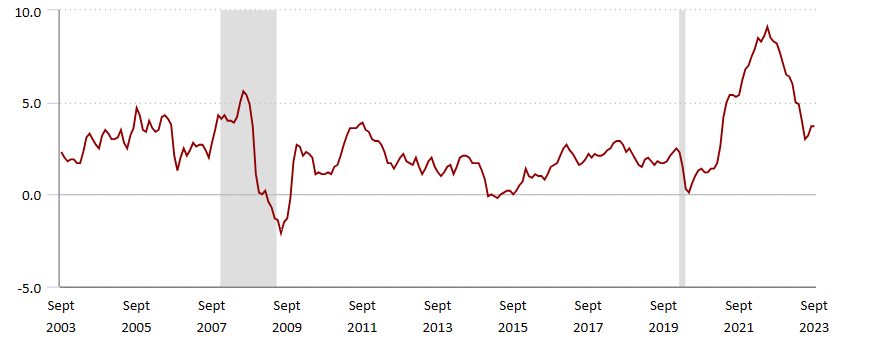

There have been countless days at newsrooms around the country talking about the inflation levels since the start of the coronavirus pandemic. In September 2020, the inflation levels were around 1.5%.

Over the past couple of years, September inflation levels rose to a high of 8.2% in September 2022 which naturally led to speculation that America was headed towards a recession. But so far, that has not been the case. According to the latest numbers that are available in September of this year, rates are lower than they have been since the pandemic began, with levels down to 3.7%. But why did inflation drop so drastically over the past year?

Dr. Mike Ryan, Department Head of Economics and Finance, said that inflation has gone down because of disinflation, which is the rate of inflation decreasing. He made sure to say that it is not deflation because this is dealing with the price of goods and services decreasing.

“One reason for the overall decrease in inflation has been that the rate of inflation for food decreased from 11.1% in 2022 to 1.4% in 2023, and the rate of inflation for energy decreased from 6.9% in 2022 to 1.8% in 2023.” – Dr. Mike Ryan, Department Head of Economics and Finance

Ryan says that another reason for the decrease in inflation is the actions of the Federal Reserve System. Due to an increase in the Discount Rate and an increase in their target for the Federal Funds Rate, Ryan says that these rates impact the money supply, and thereby creating a decrease in aggregate demand for goods and services.

As for what the American society can expect when it comes to inflation, Ryan said that the forecasts from the Federal Open Market Committee – part of the Federal Reserve System – suggest that inflation will continue to decrease to about 2.5% next year and approximately 2.2% in 2025. He stresses that these are only forecasts and mentions that various party line changes could have an effect on these numbers. He sees the projections as reasonable assuming we do not have any extreme events that impact our economy.

Ryan also had a few tips for consumers on how to cope with the levels of inflations:

- Maintain and follow a budget (always needed but especially during inflationary times)

- Check meal prices online to build your meal plan (since some food is more expensive than others)

- Pay down high-interest debt such as credit cards (financial institutions raise interest rates to offset inflation)

- Look at investments such as CDs (certificates of deposit)