Today’s criminals employ more sophisticated tactics than ever before. In a time in which society has largely shifted from using traditional physical currency to carry out transactions, opting to rather use debit and credit cards instead, scammers exploit various forms of technology in order to steal from unsuspecting victims.

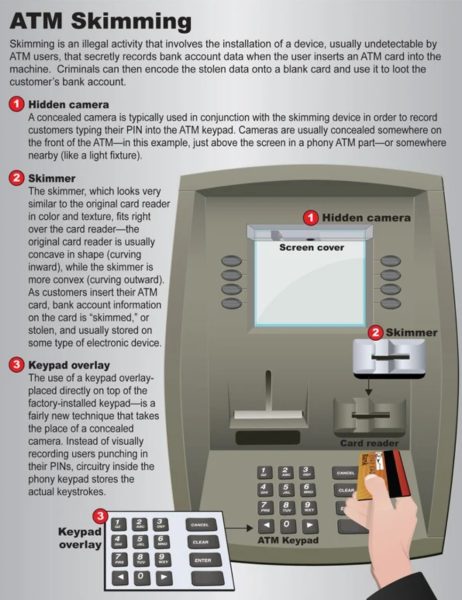

Two of the more common tactics scammers use to steal consumer card information are skimming and shimming. While close in nature skimming and shimming do have one distinct difference. Skimming targets the magnetic stripe on the back of the cards while shimming specializes in the more secure Europay, MasterCard and Visa (EMV) chip cards.

However, both accomplish the same goal of capturing the victim’s data discreetly. In turn criminals can then sell the stolen data or even create fake credit or debit cards to use for themselves.

The concealed nature of skimmers and shimmers allows these devices to be placed in a multitude of places, and are hard to identify for those who are not looking for them. They can be often found on ATMs, gas pumps and sometimes even on point of sale systems inside convenience stores and other places of business.

The Federal Bureau of Investigation urges consumers to be vigilant and inspect the payment terminal for anything out of the ordinary, such as loose parts, prior to inserting their card. Pulling the keypad and card intake to make sure there is not an overlay above them, and covering the keypad while putting in the pin just in case a pinhole camera is present are all ways one can further protect themself from card fraud.

Even though Paige Turner, a Dacula driver, has never encountered either of these devices she continues to use these methods just to be as safe as possible.

“I’ve been aware of these scams since I started driving and had to put my own gas, and I check every single time I go to the pump just to make sure I’m not at risk.” -Paige Turner, Dacula driver

While Devin Ali, a Valero clerk, says the methods of searching the pump every time a customer wants to buy gas is smart, he suggests going inside and paying with cash when possible is the only true way of knowing they will not be scammed.

With the FBI estimating these card scams costing financial institutions and buyers over $1 billion a year, it is safe to say this is very much a real and widespread problem. Taking precautionary steps should be a priority during any card transaction.

If someone has been a victim of card fraud or suspect to be a victim, freeze or lock the card and call the card provider immediately.