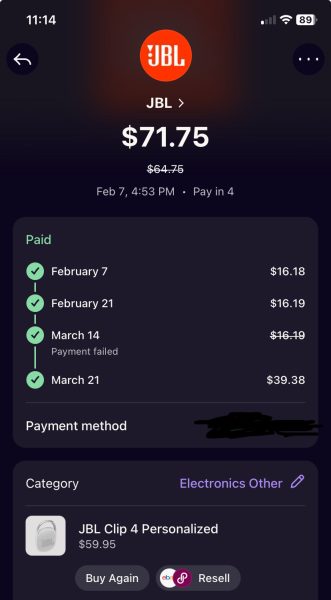

When a new semester begins, expenses pile up quickly, textbooks, lab fees and even groceries. For many students, Buy Now Pay Later apps like Klarna, Afterpay and Affirm offer a quick solution. With just a tap, the total cost shrinks into four smaller, interest-free payments. The consequences of missing one of these payments can be detrimental with an APR (Annual Percentage Rate) up to 36 percent tacked on to your purchased item .

That convenience comes at a price. A January 2025 Consumer Financial Protection Bureau report found that heavy BNPL users have an average of $5,700 more in student loan debt than non-users. They are also more likely to juggle unsecured loans and credit card balances at the same time.

For students already stretched thin, those added obligations can sneak up quickly.

“At first it felt like I was budgeting smarter, but then I realized I had payments due almost every week, and it felt like I was chasing my own money.” – Jeff Ramsey sophomore finance major

BNPL is also about to affect long-term financial futures. Beginning in fall 2025, FICO scores will start including BNPL activity. While consistent payments could help students build credit, late or missed installments may damage their scores at a time when many are just beginning to establish financial stability.

The convenience of these apps can be enticing to college students due to their restrictive budget and rising costs of what students are buying. Tickets to a concert, last minute summer road trips and DoorDash are just some of the many ways that students are using these BNPL apps. The reality is these apps can be predatory to students or users who have little to no financial knowledge and can go into extreme debt from missing payments on any of these platforms.

“I can totally understand why a lot of students use buy now pay later apps because they make large and small purchases less money, but over a longer time for users of them. If you know you’re getting paid a certain amount each week you can make a mental note of how much you’ve spent… Personally I do not use them because I don’t know enough about them and want to be able to pay my purchases in full to get them… I can understand why others would use them for things such as food if they do not have the money for it, or big purchases like a computer or necessities.”- Kaitlyn Bauer junior digital media marketing major