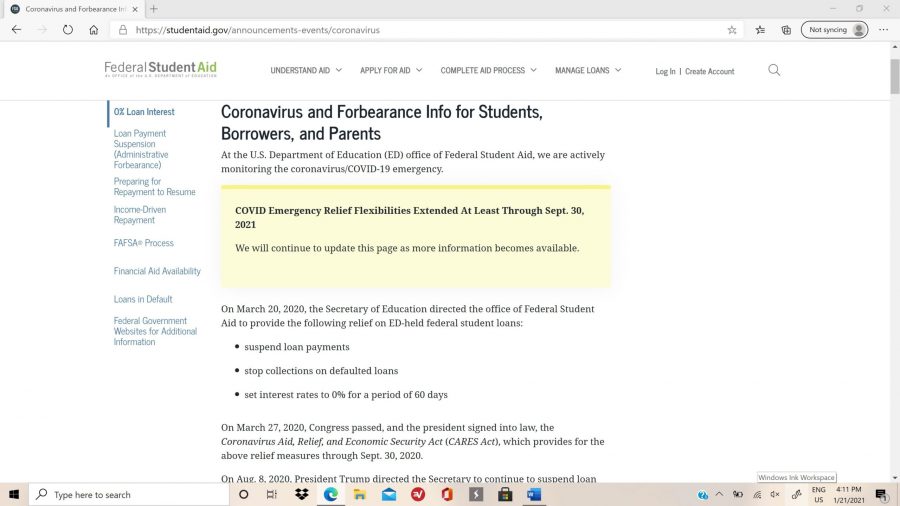

President Biden’s executive order was signed Jan. 20 at the White House soon after his inauguration as the 46th president of the United States. The executive order extends the 0% interest rate and hold on loan payment collections due to the pandemic.

This is the third time student loan relief has been extended since the pandemic began. After Congress passed the CARES act under the Trump administration last year, student loan interest rates and payments have been paused, relieving many borrowers during COVID-19. The previous extension was set to expire on Jan. 31.

The Biden administration’s extension will stay in place from now until Sept. 30, 2021. Relief like the CARES act will continue to aid families in need of recovery due to the pandemic. Students and parents are still struggling to make ends meet and so, relief efforts like this will be crucial for all borrowers.

In the meantime, what should students do with regards to their loans: pay as usual or hold off? David R. McMillion, associate director of financial aid said, “I would encourage those who can continue to make their student loan payments. Any payments made during this pause will go directly towards the loan principal and reduce the loan’s overall balance quicker. This will reduce the total amount paid over the life of the loan.”

Students who are participating in the Public Service Loan Forgiveness program will still receive credit for the months within the forbearance period according to a report from Forbes Advisor Kelly Anne Smith. However, students applying for student loan forgiveness should be cautious.

Erick Jones, director of the Student Money Management Center said,” students should be aware of these programs, but I wouldn’t recommend basing your borrowing strategy around them. The most widely applicable program, Public Service Loan Forgiveness, requires 10 years of work in specified job fields. You’ll be making payments the entire time and only have the remainder forgiven, not your entire loan amount.”

Jones, encourages students to only borrow what they need and added,” The biggest contributor to high student loan balances is just accepting whatever you’re offered.”

“If it’s in your bank account, then you’re probably going to spend it.”-Erick Jones

The SMMC offers free workshops and advisement for all UNG students. The SMMC helps students with all money management concerns, everything from setting a monthly budget to guidance on student loans and student loan forgiveness.

Students can also contact the UNG Financial Aid office with any questions they have about their personal student invoice, award offerings, loans, and loan forgiveness.

UNG students are encouraged to use these resources to their advantage, now more than ever. As the COVID-19 pandemic continues, expect more changes to the loan forbearance period later this year. The Federal Student Aid website is a key resource for keeping up to date with the latest developments and will answer questions and concerns for parents and students alike.