President Joe Biden has recently implemented the Student Forgiveness Plan. As soon as information about it was released, a lot of controversies sparked throughout the public. The population of those who have/don’t have student loans are questioning how this will affect us in the present and future.

According to Student Aid, Biden’s Student Forgiveness Plan has split up into three parts: an extension on the student loan repayment pause, focusing on the low and middle classes in terms of debt relief and making the repayment of student loans easier for current and future borrowers.

The first step resulted in the fact that most borrowers who are accumulating student loan debt are those who are a part of the low and middle classes. With this step, up to $20,000 will be provided to those who are Pell Grant recipients and up to $10,000 to those who are not. If the borrower’s or their parent’s income is under $125,000, it will be provided after the approval of their application. This benefits current college students and those who have student loan debt as long as they’ve been taken out before July 30, 2022. The White House states to make sure there is a smooth transition, Biden is extending the pause one more time. Payments will resume in January 2023.

The second step will make monthly payments on student loans more manageable by lowering how much a current/future borrower must pay monthly on undergraduate loans by half. It will also cover any unpaid monthly interest and “forgive loan balance after 10 years of payments.”, as stated by The White House. There will also be an update on the Public Service Loan Forgiveness program. The Biden Administration states, “…borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government, receive appropriate credit toward loan forgiveness.”

The final step will reduce the cost of college and make sure that schools are “held accountable when they hike up prices.” With this, colleges must keep prices reasonable and not skimp college students when it comes to the quality of their classes.

Due to this plan being new, there is not much information on how University of North Georgia students will be affected. Jill Rayner, the Director of the UNG’s Financial Aid was contacted, however, she did not respond. UNG Gainesville’s Financial Aid Office says that they only know as much as everyone else knows. Nevertheless, they are readily available to help students with any questions they have regarding the plan.

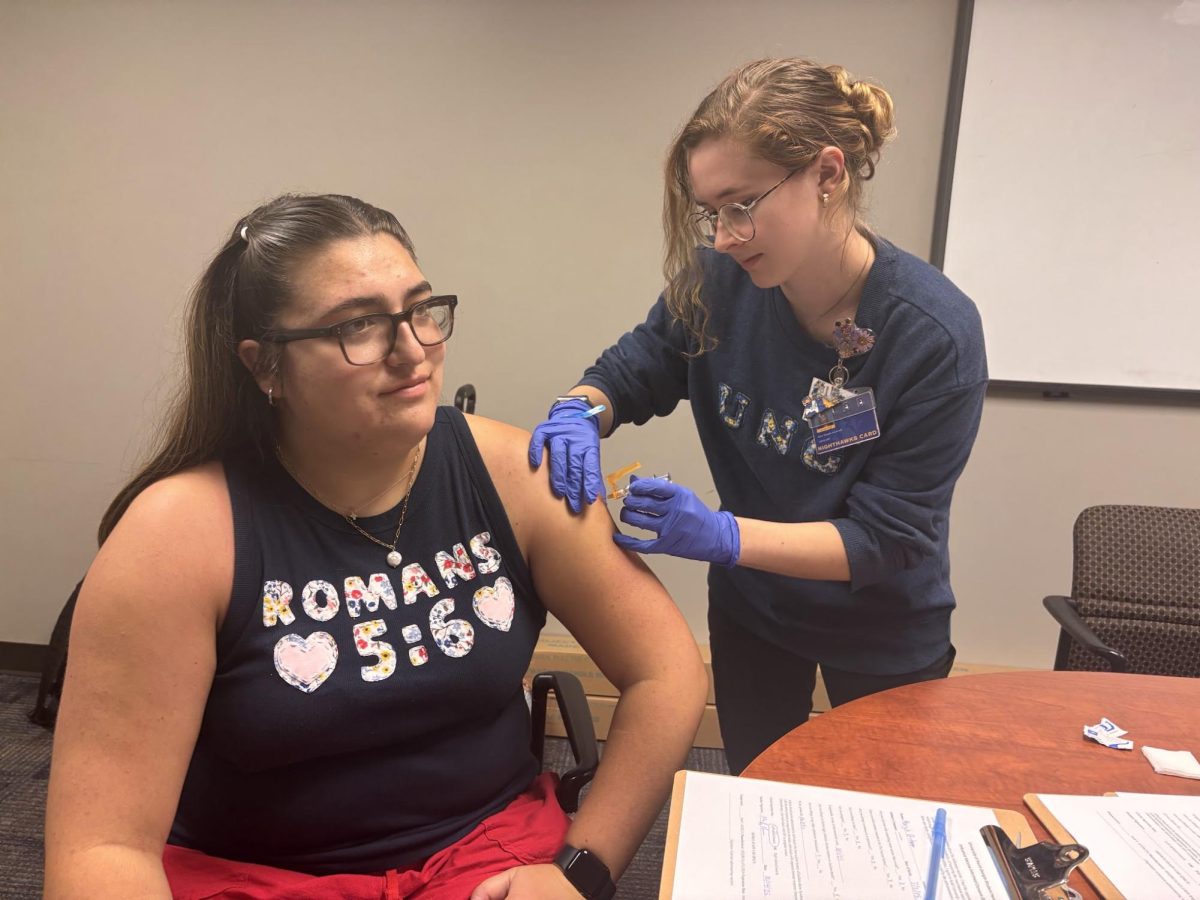

The population with student loans are delighted with Biden’s decision to move forward with this plan. Michael Herrere, a nursing major, said, “I come from an immigrated family. My mom and dad are both from Mexico. They moved to the U.S. for us to have a better education. But with that going on, my dad is the only one who’s working right now so I have to pick up a full-time job in order to get my college degree. Right now, it’s just a lot because like every paycheck I have is going straight towards school.” Michael says with this plan, he’ll be able to further his education and get his nurse practitioner degree.

Jennifer Ramsay, a Communications major who graduated in 2022, needed to pull loans while enrolled at UNG. She says, “I had Zell and Pell and a few school scholarships, but I needed about 2K extra for my first four semesters because I was living on campus. In total I have 8K.” She said that she is “pretty happy” that this plan has been set into motion. “Even though I don’t have much debt, it was something that was kind of weighing on me. I’m more happy for the people who have more than me. My sister will basically have half her debt gone, which puts her years closer to achieving her goals.”

Despite that, not everyone feels we should accept this plan with open arms. Some residents of the Gainesville community have their reservations. A resident of Gainesville says, “The people who need someone else to pay for their loans need to return their degree.” These residents feel that borrowers paying back their own loans is a part of them working hard towards their degree; if they’re not the ones paying it, then it feels like they’re invalidating their hard work. These residents are also worried that their taxable income will be contributed to the relief being provided to pay others’ student loans.

Although there are mixed opinions about the Student Forgiveness Plan, it is something that aims to provide relief to millions of U.S. citizens that need it. Whether or not it comes back to bite us in the future, we will have to wait and see.

For more information, please visit whitehouse.gov.