One source students use for financial aid is the Free Application for Federal Student Aid. According to the Student Aid website, FAFSA is used to determine how much financial aid you can receive from the federal government to help pay for college tuition and expenses.

FAFSA helps students receive scholarships and grants such as Pell Grants, Federal Supplemental Educational Opportunity Grant and the Teacher Education Assistance for College and Higher Education Grant, along with others. Students can also receive federal student loans through submitting their FAFSA which can be necessary if you do not qualify for offered scholarships.

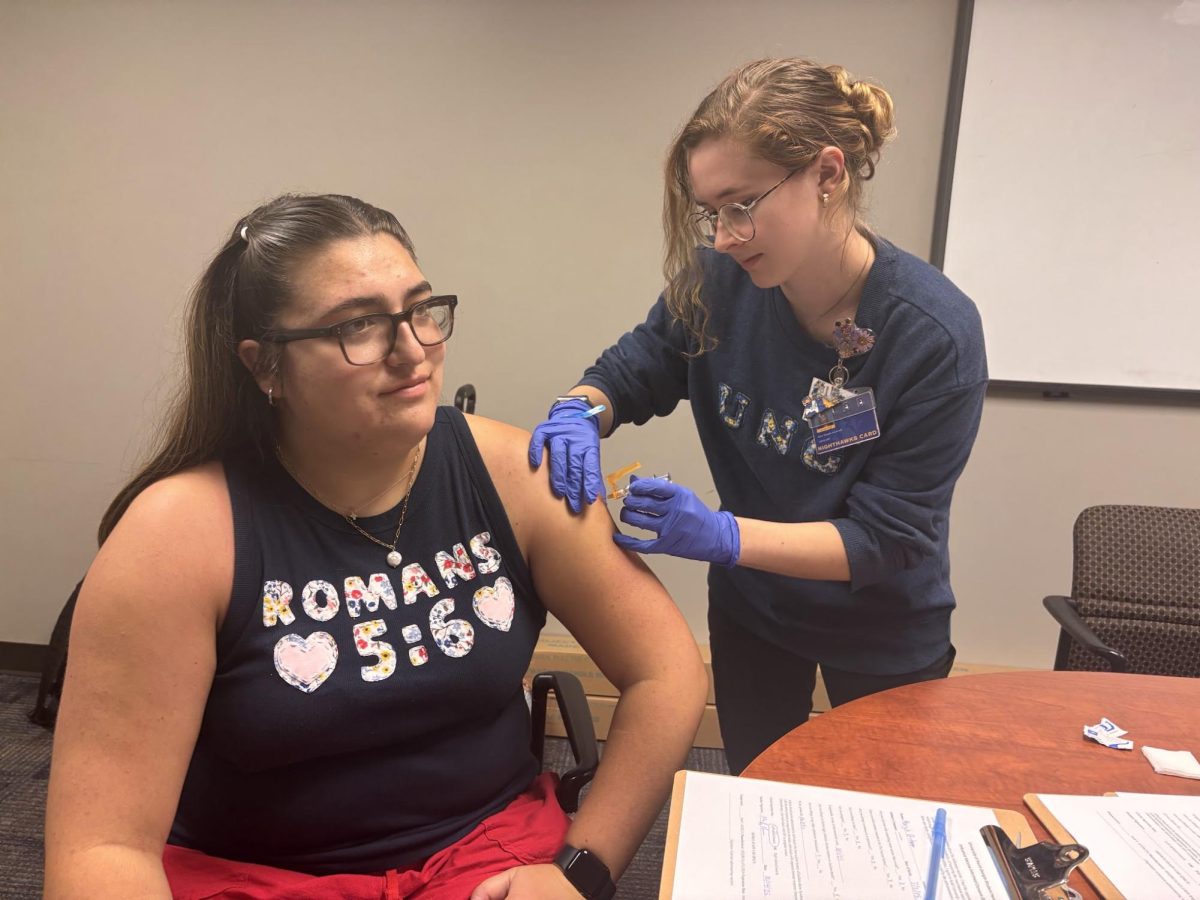

Colleges, such as the University of North Georgia, promote the use of FAFSA forms for students to receive their financial aid. Although this is one of the most common ways to gain financial aid, there is an underlying theme of students feeling “in the dark” when it comes to what financial aid is available to them and its process.

According to the Student Aid website where FAFSA forms are found, FAFSA requires students to provide their parents information for income taxes in order to determine what financial aid they are eligible for. College students are labeled “dependent” on their parents unless they are 24 years-old, married, enlisted/previously enlisted in active duty or have their own dependent.

Most students depend on their parent’s financial status to determine what help they receive. Senior history education major, Madyson McDade said “I took out student loans to help pay for college, but I received the bare minimum. My parent’s financial status prevents me from being eligible for more assistance, even though I am not their dependent.”

This puts extra pressure on independent students to need a job to pay bills while taking classes full time.

Although college campuses have financial aid offices, individual colleges do not determine what federal aid a student receives and are merely “just the middleman,” according to Rodney Harris, Associate Director of Financial Aid at UNG.